We’ve put together a map of current home prices in each SF neighborhood. I hope you find it helpful!

Market Data

Monthly Sonoma County Real Estate Report

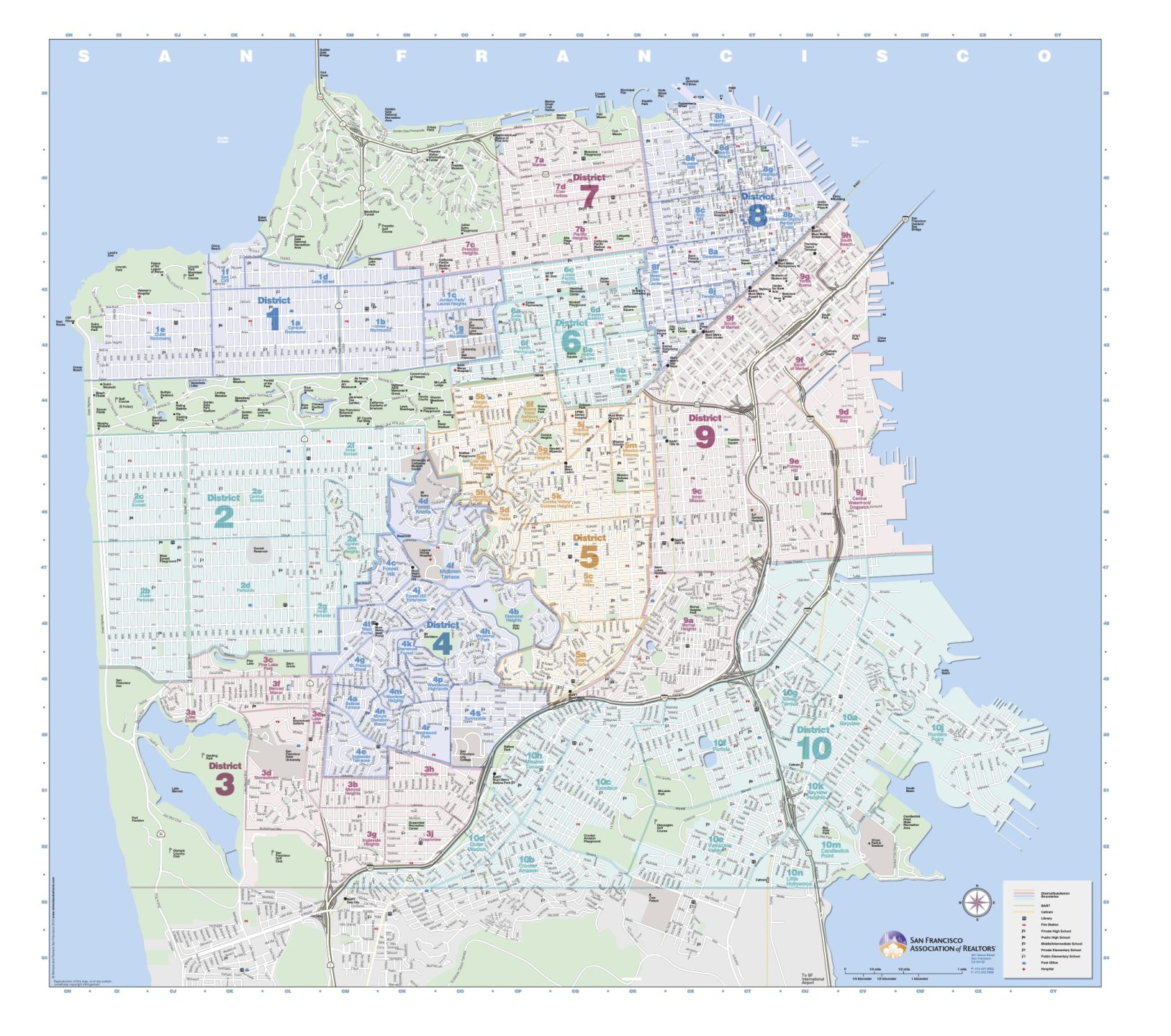

Making sense of San Francisco’s MLS district map

If you’ve been considering buying or selling a home, you’ve probably heard about MLS (Multiple Listing Service). Every region of the country has its own MLS which is the central database of all property listings in a particular area. The San Francisco MLS is SFARMLS. The MLS for Wine Country and Marin is BAREIS. The vast majority of property listings that you see on real estate websites all originate on the regional MLS.

San Francisco is a small densely-packed city with houses, condos, multi-unit buildings, and TICs spread over a small 7 mile x 7 mile area. To organize all of those properties geographically, the San Francisco MLS has 10 districts and 89 sub-districts. Here’s a link to the official SFAR MLS district map.

I recommend searching MLS through Compass.com which allows you to see every listing available with every real estate company in the city. In addition, if you are not already working with an agent, my team and I will create a Collection for you which is a dynamic online board of properties that meet your specific criteria. It allows you to message me about a home in the app in real time, no need for lots of extra text messages or emails.

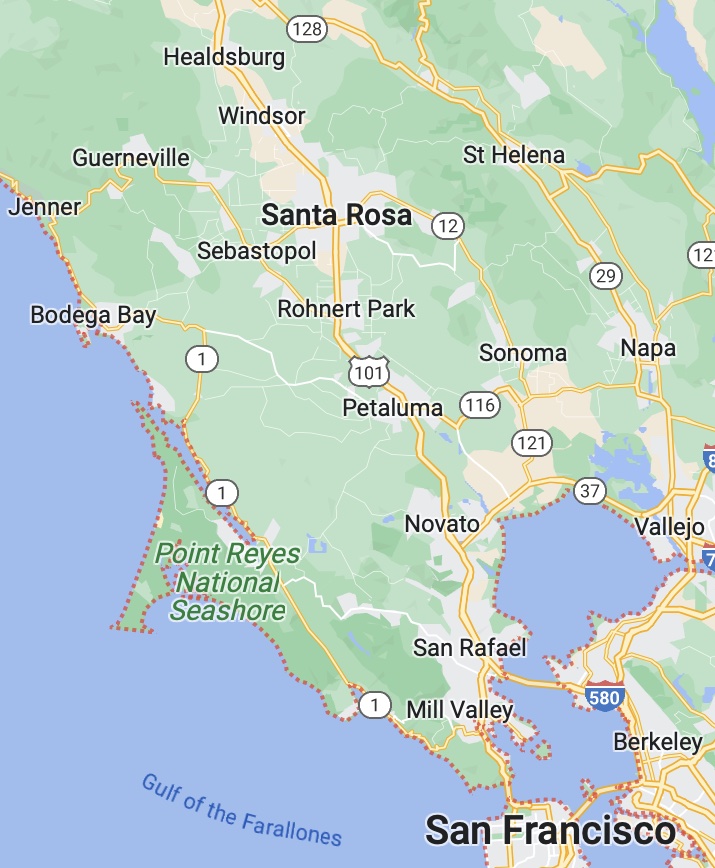

Did you know that I also represent clients in Wine Country? Here are some Sonoma County Wine Country listings currently available. This is just a sample, we have access to many more properties in the area.

Let me know if you are looking for a particular town in Sonoma County or specific price range and I’ll get to work on it.

We also have Private Exclusives which are off-market properties, they are at the request of the seller usually due to privacy reasons or other unique situations. Private Exclusives are only viewable to Compass agents and clients. Call me to check if we have anything that may fit what you’re looking for.

Whether it’s San Francisco, Marin, or Wine Country, my team and I are here and ready to help.

(Updated August 22, 2024)

Condo, TIC, Co-op. What are the differences?

What’s the difference between a condo, a TIC, and a co-op? No doubt you’ve heard of each of them but if you are like most people, you’re not sure about the specifics.

What’s the difference between a condo, a TIC, and a co-op? No doubt you’ve heard of each of them but if you are like most people, you’re not sure about the specifics.

Generally speaking, if you are looking to buy a place to live in San Francisco (and it’s not a single family house) then you are probably talking about one of these three forms of ownership. Since these are forms of ownership and not styles of construction, you can’t tell these buildings apart by physically looking at them. Here are the primary differences in how they each work:

A condo is the most common form of ownership. When you buy a condo, you own one particular unit in a building. You’ll have title to the unit plus you have rights to a use the common areas. In a condo, you’ll pay a monthly homeowners association fee, and you’ll need to abide by rules & regulations (called CC&Rs). Condos can be financed with conventional mortgages (think 30 year fixed rate loans issued by major banks). Most banks that issue mortgages will loan on a condo as long as it meets their underwriting criteria.

A tenancy-in-common (aka. TIC) is a hybrid form of ownership where you own a percentage of a multi-unit building. TICs came about as a way for people to be able to band together to buy property relatively affordably in otherwise expensive cities. As a TIC buyer, you’ll have rights to live in one unit in the building. Just like a condo, you pay a monthly fee and can use the common areas. In a TIC, the rules and regulations of ownership are spelled out in a TIC agreement. Major banks do not loan on TICs (because there is no secondary market where they can sell the loans to other banks). Financing is therefore more expensive and less attractive than condos. There are a few smaller banks around the Bay Area that offer TIC loans. They often charge a fee to complete the loan, the interest rate is often much higher than a conventional condo loan, and the rate is often locked for a shorter period than conventional financing. Down payment requirements are often higher than for condos. Although TIC owners each have their own mortgage, this form of ownership does come with some additional risk, primarily surrounding payment of property taxes and potential default by a co-owner. The TIC agreement does address the risk to some degree however buyers should be fully aware of the details before buying a TIC. The upside is that the purchase price for a TIC is almost always considerably less expensive than a comparable condo.

A co-op (aka. cooperative) is a building owned by a private corporation. It is basically an elite gated community. When you buy in to a co-op, you are purchasing shares in the corporation. You’ll pay a rather hefty monthly fee for rights to live in one unit. Buyers must first be interviewed by the board of directors (ie. other owners) for approval. The interview process generally requires buyers to provide personal financial details for review. The board may accept or reject buyers for any reason. Like TIC financing, terms for co-op financing are less attractive than conventional condo financing and the number of banks that will issue loans are limited. Co-op buildings tend to be well maintained (because they usually have substantial amounts of cash in the bank). Co-ops do not allow rentals, so purchasing one as an investment property is not an option. Like condos and TICs, co-ops may have shared common areas as well as rules and regulations governing what owners can and cannot do.

—

This is just a quick summary of the differences in these forms of ownership. I’ve sold all of these types of properties and am happy to discuss the specifics with you. You can find me anytime at 415-971-5651.

From SF to Wine Country (and everything in between)

For more than a decade, I’ve been incredibly fortunate to have had the opportunity to represent many home buyers and sellers throughout San Francisco. My real estate business has grown exponentially since that time as clients have called upon us to represent them in nearby counties. As a result, my team and I are excited to now include Marin & Wine Country in the areas that we serve.

In addition to San Francisco, we represent real estate clients in Healdsburg, Sonoma, Santa Rosa, Guerneville, Petaluma, Windsor, Occidental, Sebastopol, Napa, St Helena, Calistoga, Yountville, Novato, Mill Valley, San Rafael and surrounding towns. If you are considering buying or selling a home in Wine Country, Marin, or San Francisco, my team and I are here and ready to help!

When is the best time of year to buy or sell a home in San Francisco?

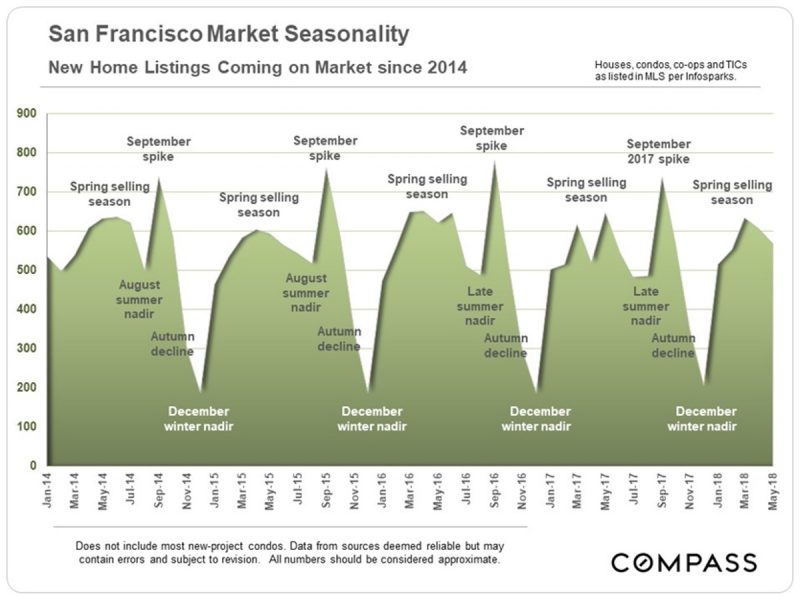

I am often asked about the seasonality of real estate in San Francisco. As it has been for a long time, we are in a seller’s market in SF however there are definitely some fluctuations throughout the year.

Sellers: The majority of the year is still very good for sellers, especially for single family homes, however the best time for sellers is in September/October when the weather is usually sunny and dry and fog is nowhere to be seen. This time of year is known as “San Francisco’s summer” even though it is really autumn everywhere else. Throngs of buyers are visiting lots of open houses on these sunny weekends, multiple offers are the norm, and sale prices that far exceed list prices are very common.

Buyers: If you are buying and want to have a shot at getting a (relative) bargain, you’ll want to do that in July/August or wait until November/December (but the number of available listings will be limited). The number of buyers that you’ll compete with are usually relatively low at this time, and the resulting number of offers and sale prices will also likely be in your favor. Of course, as with most things in San Francisco, each neighborhood and price range has it’s own unique nuances, so please let me know if you need advice on your particular situation.

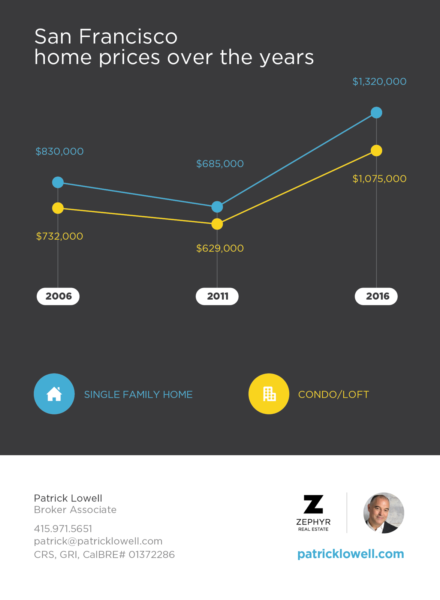

The history of San Francisco home prices

How to look up permits for any San Francisco property

Did you know that there is a site that allows you to view permits and complaints for all properties in the city? This comes in very handy if you are thinking of purchasing a home (or if you are a nosy neighbor).

Just head to Department of Building Inspection’s website and enter the property address. There you’ll see all permits relating to electrical, plumbing and building as well as the complaints that may be on file for that location.

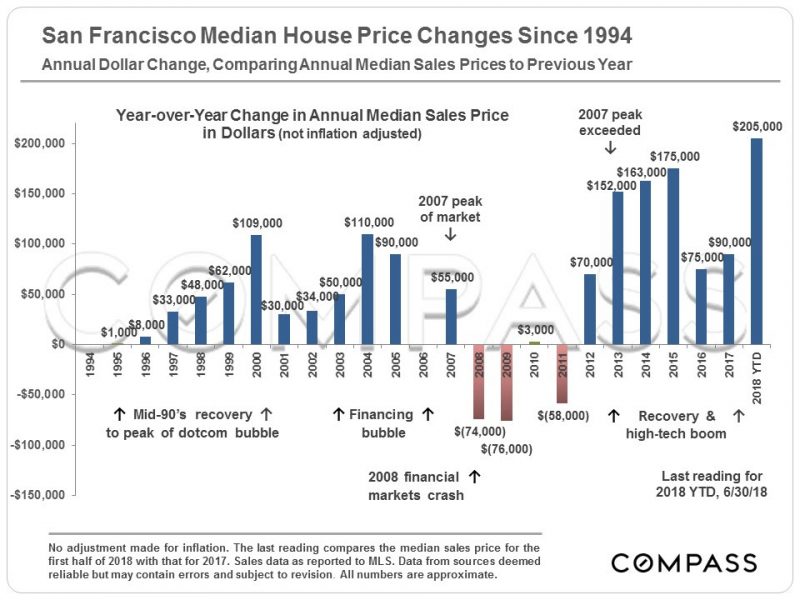

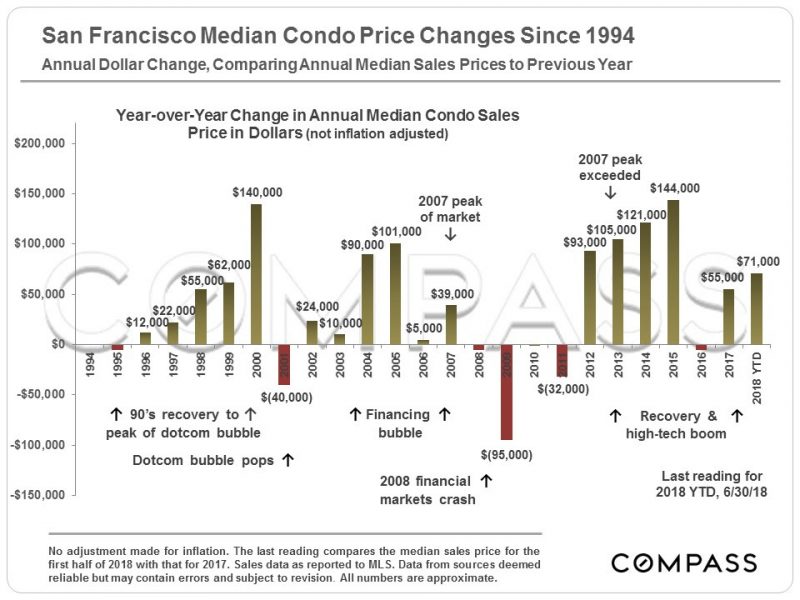

San Francisco real estate price changes since 1994

By any measure, the heat of the San Francisco market in the first half of 2018 has been among the most blistering ever. Probably only 3 or 4 other periods over the past 50 years have seen a comparable intensity of buyer demand with regard to the supply of listing inventory available to purchase. Though all segments performed strongly, the market was particularly ferocious in the lower and middle-price segments of single family homes.

Here are the median price changes for San Francisco houses and condos sold from 1994 to 2018.

Single family homes:

Condos:

Tuesday Broker Tour is another opportunity to see homes in SF

It’s no secret that most open houses in San Francisco occur on weekends, especially on Sunday afternoons. That can be a real challenge for buyers who happen to be out of town for the weekend but still want to check out a property. Tuesday Tour is an open house for brokers and agents; basically it is an opportunity for industry professionals to tour available homes during the week. What many buyers don’t know however is that the public is almost always welcome to these open house events. You can check to see if a particular property is open on Tuesday by asking your agent or broker. Tuesday open house times vary depending on the MLS district where the property is located. Here is a map of the districts. Here is a list of the Tuesday open house times for each district. The subdistricts can get confusing, here is a list of those. The open house times are broken down to “new tour” and “repeat tour”. New tour is for new listings and repeat tour is for properties that have already been open at least once before. A few neighborhoods have broker tour on Wednesdays instead of Tuesdays since it was tough to see all the properties in one day. Those are: Mission Bay, South of Market, Yerba Buena, South Beach. Want to know if a property will be open on Tuesday or Wednesday? Just ask me!

A quick history of San Francisco real estate prices

How do I get a good deal when buying San Francisco real estate?

Buying a home or condo in San Francisco can be intimidating for buyers. The prospect of competing with dozens of frenzied buyers for that one special place can take the wind out of your sails pretty quickly. But here is some good news…

Time of year matters

The SF real estate market tends to be slowest in November and December, that can mean better deals for buyers. Less competition and lower prices are more likely during these two months than during the rest of the year. Although inventory is very limited during this notoriously quiet period, some of the listings that are available will be relatively good bargains.

Back on market, high number of days on market, price drops

Beyond time of year, there are some other ways to find potentially good deals. Watch for properties that have recently come back on the market after being in contract. Although it’s important to understand why the contract was cancelled, these situations sometimes indicate that a seller may be frustrated and more flexible on price and terms. Properties that have been on the market a while (with a high number of days on market, over 60 days) often will signal that the seller is open to some negotiating. Keep an eye out for listings with recent price reductions. All of theses are indicators that there may be a window of opportunity for the savvy buyer.

I’m happy to send you my picks of the best deals in the neighborhoods you’re interested in, just let me know.

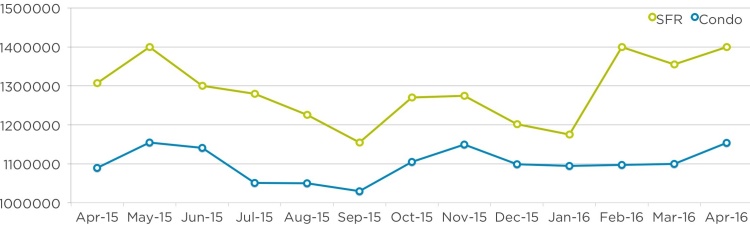

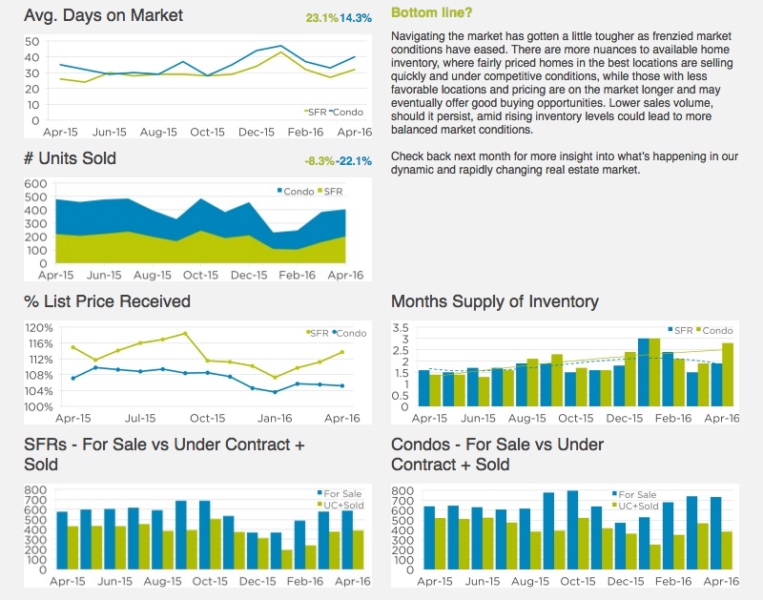

SF Real Estate Market Update May 2016

Home sales activity, representing buyer demand, is one of the most basic market trend indicators. We typically compare the same time period because home sales are seasonal, lower in the winter and summer months and higher in the spring and fall. Over the first four months of 2016, the number of homes sold declined by 13% for single family homes and 10% for condominiums versus the same months in 2015. While this does represent lower demand, reviewing other indicators will provide a better understanding of overall market conditions.

The amount of supply available, how long it takes to sell and at what price, will provide a better indication of market dynamics buyers and sellers can expect. On the supply side, the inventory of available homes for sale remains low, but it has increased compared to last year. Single family home inventory was up slightly in April 2016 versus the prior year to 587 homes. Condominium inventory year-over-year was up by 94 units or 15%. In terms of the time required to sell homes placed on the market, the average in 2016 was 35 days, four days longer than in 2015. A selling time under 60 days is considered short and seller favorable, indicating an active market. Finally, the median home price, which represents market conditions motivating a buyer and seller to agree upon a sale price, surpassed or equaled its twelve month high in April 2016.

Median Sales Price |

7.1% |

5.9% |

Patrick’s Properties

239 8th St #7

South of Market

Hip urban loft with large private patio, parking & storage

Listed at $899,000

Open house Monday, May 30th: 1pm-4pm

81 Clairview Ct

Midtown Terrace

Sweet single family home, 3 beds 1 bath

Listed at $895,000

Open house Tuesday, May 31st: 1pm-2:30pm

1350 Natoma St #7

Inner Mission

Newer townhome-style condo. 2 beds 2.5 baths, parking & storage

Listed at $849,000

Showings begin June 11th

san francisco real estate market update: April 2016

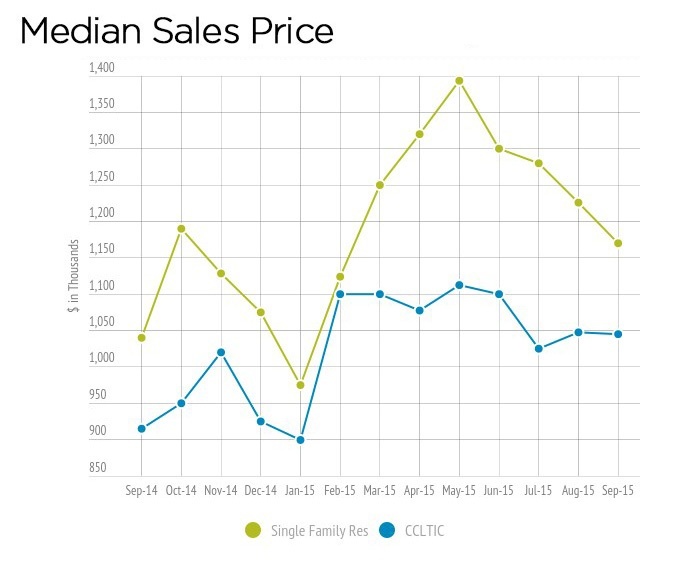

| Over the last four years, the San Francisco real estate market can easily be referred to as frenzied. The result has been a huge surge in home prices. Recent data though seems to indicate that the trend may be shifting.

Prices over the last three years appreciated by a whopping 35.02%, but looking at a year-over-year analysis, we can see that the vast majority of the gain, almost 31%, happened between 2013 and 2015. Over the last twelve months, the rate of appreciation has slowed to just 3.80%. |

| Condos & Single Family Homes Median Sale Price |  |

|||

| 2013 – 2016 / Year Over Year | ||||

|

||||

| It’s also interesting to note that most of 2013 – 2015 saw a steady smooth upward price trend but the last twelve months was filled with multiple peaks and valleys.

The underlying market dynamics haven’t really changed. Demand is high, inventory remains low, interest rates are stable, and financing is no easier or harder to secure then it was a year ago. Of course many other factors impact the housing market (local employment opportunities, the stock market, politics, consumer confidence, etc). They are each likely impacting the current market adjustment to some degree. We have all expected that the pace of appreciation of San Francisco real estate would start to cool down a bit. While we may have reached that point, I definitely do not view this as the bursting of a bubble. If you’ve been thinking of selling or buying a home, give me a call and we can chat about how this market shift could impact your real estate goals. |

|

|

|||

Patrick Lowell Patrick LowellBroker Associate, CRS, GRI BRE# 01372286 415.971.5651 [email protected] www.patricklowell.com |

|||

|

|

|||

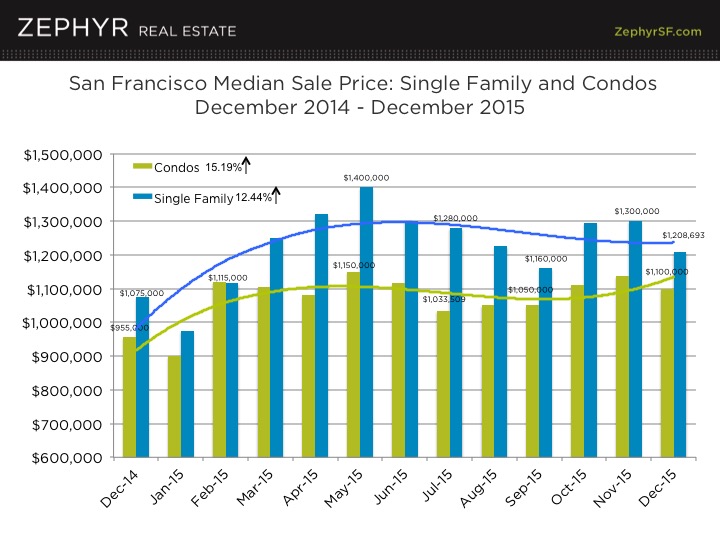

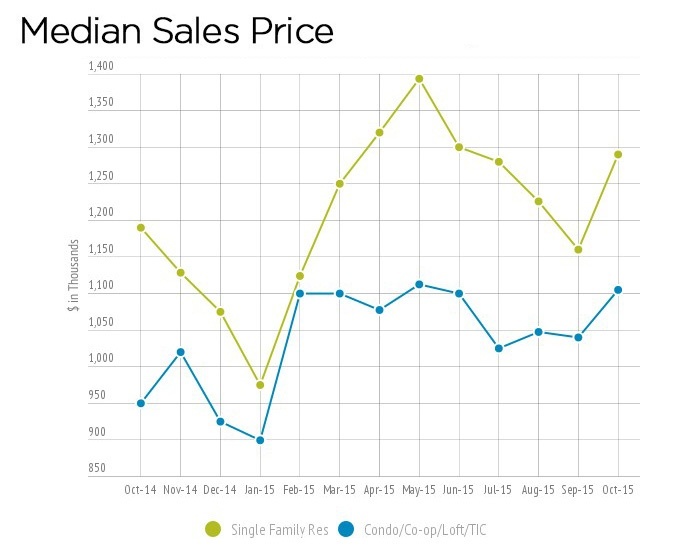

San Francisco Real Estate Prices for 2015

It’s been another wild year in SF real estate. The median sale price for a condo is $1,100,000 which is up more than 15% from a year ago. Single family home prices jumped almost 13% to $1,250,000. As we enter 2016, that strong upward trend is likely going to cool. With mortgage interest rates increasing and international financial markets showing more signs of instability, my prediction is that we’re likely heading toward a somewhat less robust seller’s market than we have seen in the last few years. As always, it will be interesting to see how things unfold. If you are thinking of selling or buying a home, feel free to get in touch, I’m here to help.

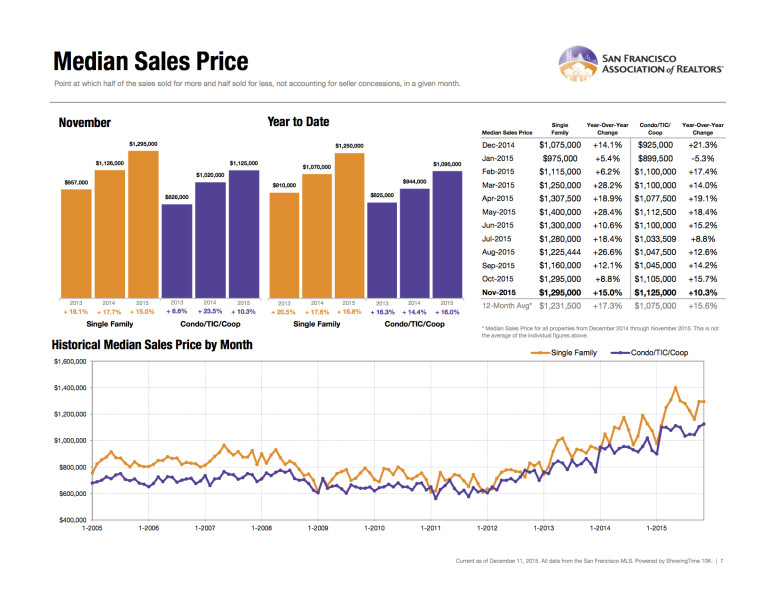

How’s the market in SF? The numbers are in for November 2015

San Francisco Real Estate Market Update

Staying on top of market activity is critical in order to make an informed decision about buying or selling.

Check out my San Francisco market statistics for November

How’s the market in San Francisco?

“How’s the market?” This is one of the most frequent questions that I get from clients and friends. As things cool down for the winter season, I thought it may be time to help shed some light on it. We’ve put together a few graphs to show you exactly what’s happening in the market right now. I have much more data to share, so feel free to let me know if you have questions about your specific property or neighborhood.

How’s the Real Estate Market in San Francisco?

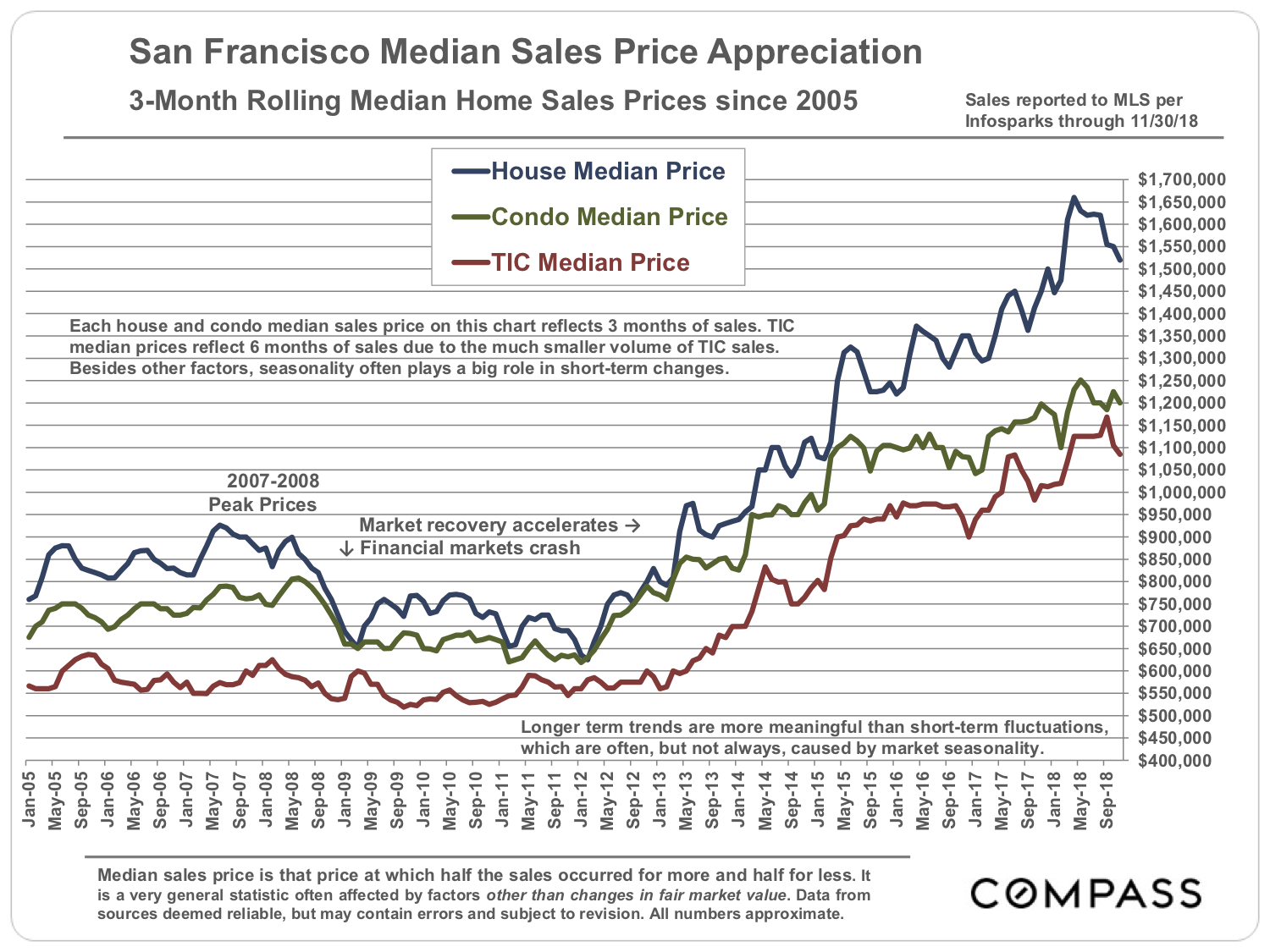

Every day without fail, someone asks me how the market is doing. I love this because it tells me that people are interested in our city and engaged with real estate. Everyone is curious about prices and trends and what the future may hold for the local real estate market in SF. I thought it may be helpful to prepare a city-wide 5 year trend of median prices of single family homes, condos, and TICs. So here it is! I have tons more data to share on a neighborhood level too, so just let me know if you have questions about your specific area of SF. Enjoy!

The Rockwell, new luxury condos in Pacific Heights

The Rockwell is a new and highly anticipated Pacific Heights condo community going up near the corner of Franklin and Pine. When it’s finished in late 2016, the project will include two 13 story buildings for a total of 260 condos. The Rockwell includes a 24 hour lobby attendant, owner’s club room, fitness center, plus a stunning rooftop lounge and outdoor terrace. The units are comprised of 1 and 2 bedroom homes priced from $749,000 to $1,624,000. The penthouse units will be priced higher. Most of the larger units include stacked parking for 1 car. Monthly homeowners dues range from the $800’s to high $900’s per month depending on the unit. It will be awhile before buyers can move in, but it looks like it will be worth the wait. Let me know if you’d like a preview tour of this impressive property.

The numbers are in for 2014

The 2014 figures are in for the San Francisco real estate market. Median price for a condo is $953,000 (that’s a huge 25% jump from 2013). Median single family home price is $1,080,000 (up 14%). More info at www.NYTimes.com

415.971.5651

415.971.5651

patrick@

patrick@

SF Office

SF Office