We’ve put together a map of current home prices in each SF neighborhood. I hope you find it helpful!

Education

Condo, TIC, Co-op. What are the differences?

What’s the difference between a condo, a TIC, and a co-op? No doubt you’ve heard of each of them but if you are like most people, you’re not sure about the specifics.

What’s the difference between a condo, a TIC, and a co-op? No doubt you’ve heard of each of them but if you are like most people, you’re not sure about the specifics.

Generally speaking, if you are looking to buy a place to live in San Francisco (and it’s not a single family house) then you are probably talking about one of these three forms of ownership. Since these are forms of ownership and not styles of construction, you can’t tell these buildings apart by physically looking at them. Here are the primary differences in how they each work:

A condo is the most common form of ownership. When you buy a condo, you own one particular unit in a building. You’ll have title to the unit plus you have rights to a use the common areas. In a condo, you’ll pay a monthly homeowners association fee, and you’ll need to abide by rules & regulations (called CC&Rs). Condos can be financed with conventional mortgages (think 30 year fixed rate loans issued by major banks). Most banks that issue mortgages will loan on a condo as long as it meets their underwriting criteria.

A tenancy-in-common (aka. TIC) is a hybrid form of ownership where you own a percentage of a multi-unit building. TICs came about as a way for people to be able to band together to buy property relatively affordably in otherwise expensive cities. As a TIC buyer, you’ll have rights to live in one unit in the building. Just like a condo, you pay a monthly fee and can use the common areas. In a TIC, the rules and regulations of ownership are spelled out in a TIC agreement. Major banks do not loan on TICs (because there is no secondary market where they can sell the loans to other banks). Financing is therefore more expensive and less attractive than condos. There are a few smaller banks around the Bay Area that offer TIC loans. They often charge a fee to complete the loan, the interest rate is often much higher than a conventional condo loan, and the rate is often locked for a shorter period than conventional financing. Down payment requirements are often higher than for condos. Although TIC owners each have their own mortgage, this form of ownership does come with some additional risk, primarily surrounding payment of property taxes and potential default by a co-owner. The TIC agreement does address the risk to some degree however buyers should be fully aware of the details before buying a TIC. The upside is that the purchase price for a TIC is almost always considerably less expensive than a comparable condo.

A co-op (aka. cooperative) is a building owned by a private corporation. It is basically an elite gated community. When you buy in to a co-op, you are purchasing shares in the corporation. You’ll pay a rather hefty monthly fee for rights to live in one unit. Buyers must first be interviewed by the board of directors (ie. other owners) for approval. The interview process generally requires buyers to provide personal financial details for review. The board may accept or reject buyers for any reason. Like TIC financing, terms for co-op financing are less attractive than conventional condo financing and the number of banks that will issue loans are limited. Co-op buildings tend to be well maintained (because they usually have substantial amounts of cash in the bank). Co-ops do not allow rentals, so purchasing one as an investment property is not an option. Like condos and TICs, co-ops may have shared common areas as well as rules and regulations governing what owners can and cannot do.

—

This is just a quick summary of the differences in these forms of ownership. I’ve sold all of these types of properties and am happy to discuss the specifics with you. You can find me anytime at 415-971-5651.

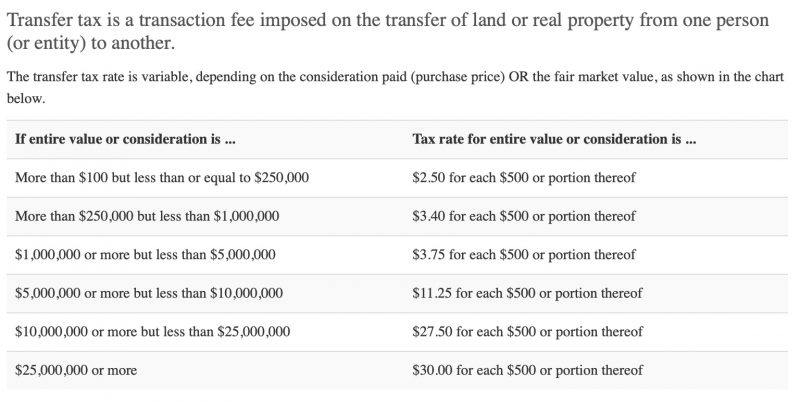

San Francisco Real Estate Transfer Tax

Sellers have many things to consider when they prepare to sell their home or condo. One of the expenses that can surprise some sellers is the City & County of San Francisco Transfer Tax. This hefty tax is based on the sales price and is deducted from your proceeds by the escrow company. In transactions involving new construction properties, buyers are generally required to pay this tax. (Updated March 2022)

How much can you expect to pay in transfer tax?

Price Per Square Foot: It May Not Be As Reliable as You Think

If you are a routine grocery shopper, then you already know that comparing ‘per-unit’ pricing is a smart way to shop. If something costs .48 cents per ounce then you can easily compare different brands and sizes and quickly determine that .51 cents per ounce is likely more than you need to spend. It is logical then that the same process would apply to home prices.

Continuing with the grocery analogy, the concept works well when comparing apples to apples. Price per square foot is a good barometer to consider when looking at houses and condos that are almost identical or at least very similar to each other. This works well on a new construction cul de sac in the suburbs and in high rise buildings in the city. The challenge in SF however is that the housing inventory is very old and uniquely diverse. This means that one home is usually very different than the one next door, including the details of the interior, the exterior, the parking, the view, you get the picture.

The other challenge with price per square foot in the city is that we are often relying on inaccurate square footage figures from tax records. This means that the fundamentals are not accurate, so any comparison based on square footage would be incorrect. So while price per sq foot might seem perfectly logical, it may not really be as solid a data point as you think. Each situation is different, so let me know what you are looking for and we will take a closer look.

(Updated: June 8, 2021)

Looking for a rental in San Francisco? Be careful!

There are lots of internet scams out there, especially when it comes to rental housing ads. I have some suggestions to help you to avoid falling victim. Here is how the fraud works… the scammer lures prospective tenants by posting very convincing ads on various legitimate rental websites using addresses and photos and descriptions of real San Francisco apartments and condos. They usually just copy the details and photos from properties that were recently advertised online for sale.

The scammer advertises these places on many web sites, often with rents that seem attractively low. Once you contact them, they will eventually ask you to provide confidential info or request that you apply or send money to them to secure your spot in order to arrange a showing appointment, don’t do it!

They even sometimes use the name of the legitimate local real estate agents and brokers. Presumably this is to confuse the prospective tenant in to thinking that they are dealing with a reputable person. Of course they conveniently include a bogus phone number and email link so that you communicate with the scammer directly and not with any actual legitimate agent.

Be sure you are using reputable rental sites (like LiveLovely.com or Trulia.com) and always keep your eyes open for red flags or things that don’t seem to add up. Although the reputable sites do get many fraud postings, they are more likely to remove those scams quickly when they get flagged.

Here is what you need to know…

If you contact an owner about an apartment and he or she is unwilling or unable to show you the apartment within a few days, move on. If there is a dramatic story about illness or death or distant family members causing a delay in the showing, move on. If the language that the “landlord” uses seems very odd to you, move on.

Never ever ever complete an application or send money to anyone until you have personally toured the apartment. Also when you do go to see an apartment, don’t go alone.

If you find a place that looks interesting, I suggest that you Google the address to see if there are other ads online for that address. Use a few versions of the address in your searches, like 123 Main Street #5, San Francisco or 123 Main St Apt 5 San Francisco. If your online search turns up some links to the same unit currently listed for sale on major real estate sites like Zillow.com or Realtor.com, then that’s a sign that the property may not actually be for rent and you are likely dealing with a fraudster. While it is possible that a property could be legitimately advertised for both sale and rent simultaneously, it is not the most likely scenario. In any event it would be easy enough to decipher by speaking with the actual agent representing the seller.

You should also Google the name of the agent, for example if the ad says to contact Patrick Lowell at Zephyr Real Estate for information, just Google that name to see if the phone number and website that you find online match what’s in the ad. If you are not sure if an ad is legitimate and you’ve searched for the agent’s name and found a phone number that is different, call it and speak with the agent. Often it is someone like me who can tell you right away that the ad is a scam and that they did not post it.

Bottom line, follow your gut, if something does not seem right, it probably isn’t. Trust your instincts.

Remember: NEVER send money or complete any application until you have toured an apartment in person.

Here is an example of an actual rental scam email, most of them follow a similar pattern:

—–

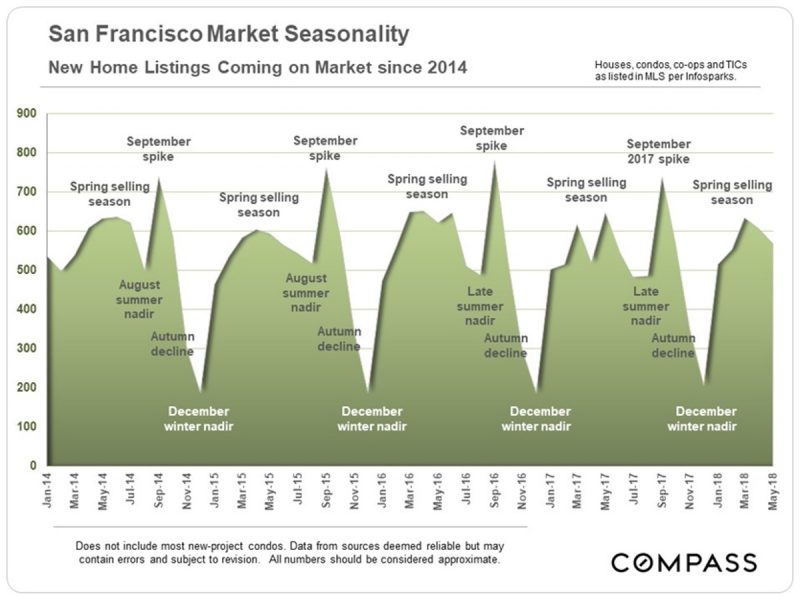

When is the best time of year to buy or sell a home in San Francisco?

I am often asked about the seasonality of real estate in San Francisco. As it has been for a long time, we are in a seller’s market in SF however there are definitely some fluctuations throughout the year.

Sellers: The majority of the year is still very good for sellers, especially for single family homes, however the best time for sellers is in September/October when the weather is usually sunny and dry and fog is nowhere to be seen. This time of year is known as “San Francisco’s summer” even though it is really autumn everywhere else. Throngs of buyers are visiting lots of open houses on these sunny weekends, multiple offers are the norm, and sale prices that far exceed list prices are very common.

Buyers: If you are buying and want to have a shot at getting a (relative) bargain, you’ll want to do that in July/August or wait until November/December (but the number of available listings will be limited). The number of buyers that you’ll compete with are usually relatively low at this time, and the resulting number of offers and sale prices will also likely be in your favor. Of course, as with most things in San Francisco, each neighborhood and price range has it’s own unique nuances, so please let me know if you need advice on your particular situation.

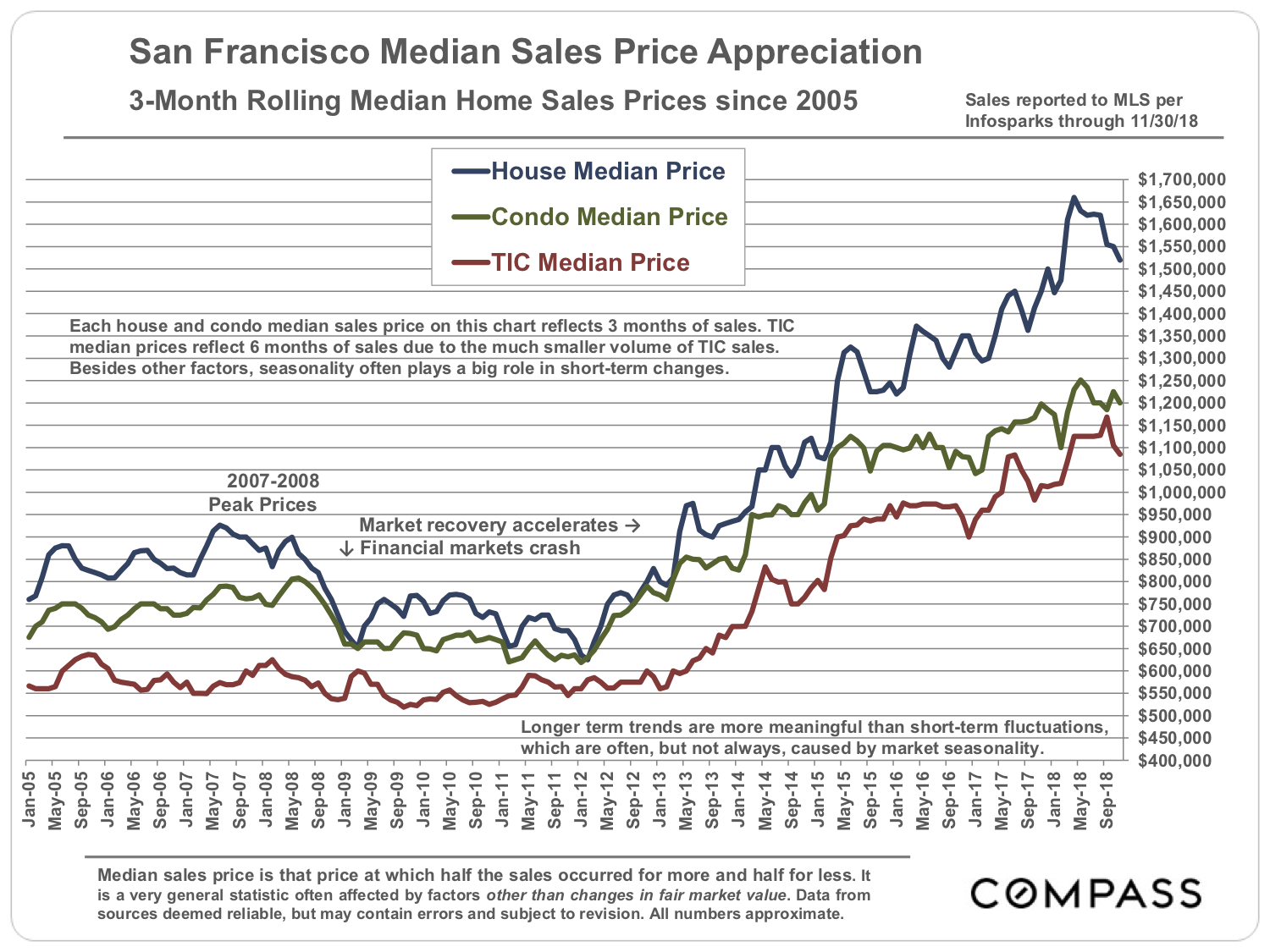

The history of San Francisco home prices

How to look up permits for any San Francisco property

Did you know that there is a site that allows you to view permits and complaints for all properties in the city? This comes in very handy if you are thinking of purchasing a home (or if you are a nosy neighbor).

Just head to Department of Building Inspection’s website and enter the property address. There you’ll see all permits relating to electrical, plumbing and building as well as the complaints that may be on file for that location.

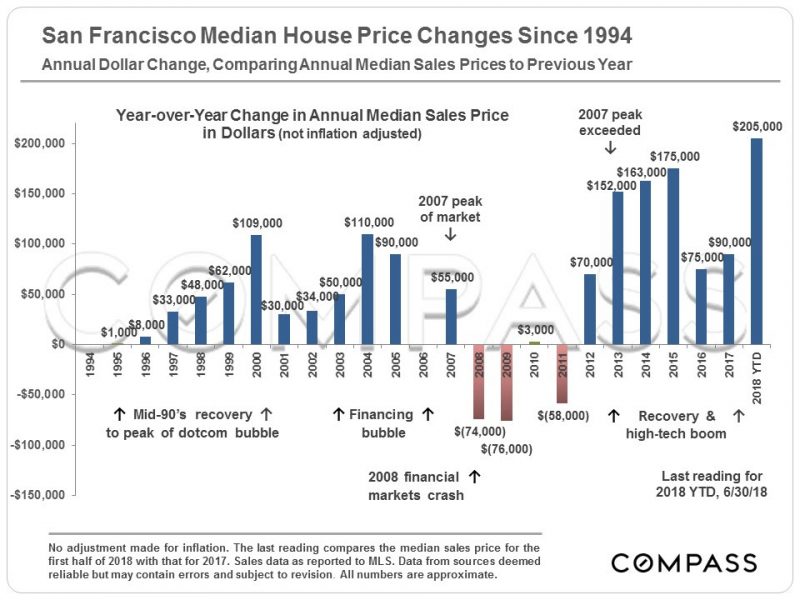

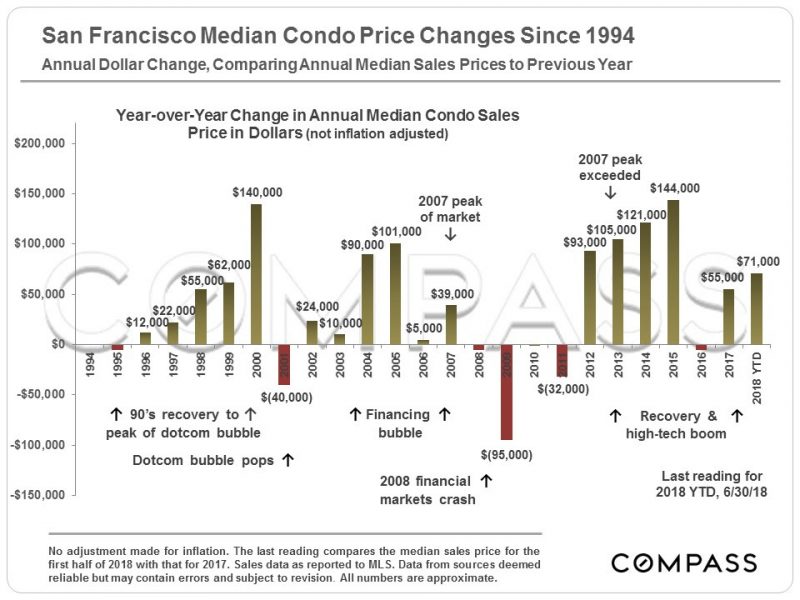

San Francisco real estate price changes since 1994

By any measure, the heat of the San Francisco market in the first half of 2018 has been among the most blistering ever. Probably only 3 or 4 other periods over the past 50 years have seen a comparable intensity of buyer demand with regard to the supply of listing inventory available to purchase. Though all segments performed strongly, the market was particularly ferocious in the lower and middle-price segments of single family homes.

Here are the median price changes for San Francisco houses and condos sold from 1994 to 2018.

Single family homes:

Condos:

After The Equifax Breach: What You Need To Know

The recent Equifax security breach makes it clearer than ever that consumers need to take data security very seriously. There are steps you can take today to maintain control of your credit and personal information. If you haven’t already placed a security freeze on your credit files, maybe you should. Here’s what you need to know.

How do I get a good deal when buying San Francisco real estate?

Buying a home or condo in San Francisco can be intimidating for buyers. The prospect of competing with dozens of frenzied buyers for that one special place can take the wind out of your sails pretty quickly. But here is some good news…

Time of year matters

The SF real estate market tends to be slowest in November and December, that can mean better deals for buyers. Less competition and lower prices are more likely during these two months than during the rest of the year. Although inventory is very limited during this notoriously quiet period, some of the listings that are available will be relatively good bargains.

Back on market, high number of days on market, price drops

Beyond time of year, there are some other ways to find potentially good deals. Watch for properties that have recently come back on the market after being in contract. Although it’s important to understand why the contract was cancelled, these situations sometimes indicate that a seller may be frustrated and more flexible on price and terms. Properties that have been on the market a while (with a high number of days on market, over 60 days) often will signal that the seller is open to some negotiating. Keep an eye out for listings with recent price reductions. All of theses are indicators that there may be a window of opportunity for the savvy buyer.

I’m happy to send you my picks of the best deals in the neighborhoods you’re interested in, just let me know.

How to buy a home in San Francisco if you are an expat

If you are considering a move to the U.S. from another country, you will quickly learn that the process of buying a home here is unique and probably even a little baffling at first. Here is what you need to know:

- Step one is to find the right real estate broker to guide you. In San Francisco, like much of the U.S., buyers and sellers each have their own dedicated broker to help them. Your broker is your primary advocate throughout the real estate purchase process and can help you to buy any available home on the market regardless of which broker is representing the seller. He or she has a fiduciary duty to represent your best interests. Sellers pay the commission which is the compensation for both brokers. Buyers rarely pay any commission at all.

- Get pre-approved for a loan. Without a U.S. credit report and social security number it can sometimes be challenging to get a mortgage loan. Here is how the system typically works: after a potential home buyer applies for a loan, the mortgage lender uses their social security number to check credit history which is pulled from three credit bureaus: Trans Union, Equifax, and Experian. Each of these bureaus collects data from various creditors like banks and credit card companies regarding an individual’s payment history, amounts owed, etc. That data is used to formulate a score called FICO which gauges an individual’s perceived credit-worthiness. The score can range from 300-850. Anything over 700 is generally considered very good. The credit bureaus and resulting FICO score only considers credit history earned in the U.S., not overseas. If you are new to the U.S., this is clearly a bit problematic. There are some alternatives for expats who are new to the U.S., so finding the right mortgage lender is key. Your real estate broker can refer you to a few lenders that can help.

- Start looking at neighborhoods and homes with your broker. This step may take a while as you learn the areas and nuances of the city along with the various property types that fit into your budget. San Francisco is geographically small but it has 89 distinct neighborhoods, so there is a lot to learn. Your broker can give you access to MLS, the database of all available homes in the city.

- Once you find the right home for you, then it’s time to make an offer. Offers are comprised of price and various terms that your broker will discuss in detail with you. Offers can be contingent upon certain events like a professional home inspection or even full mortgage loan approval. Your broker will discuss the pros and cons of various offer terms to make it attractive to the seller while still protecting your interests. The timeframe of offering on a home to actually getting keys in your hand is generally about 35 days or less.

I have represented many buyers from other countries. I’d be glad to sit down and talk with you about the process to see if buying a home in San Francisco is the right move for you. Just let me know when you’d like to meet. I can be reached at (415) 971-5651.

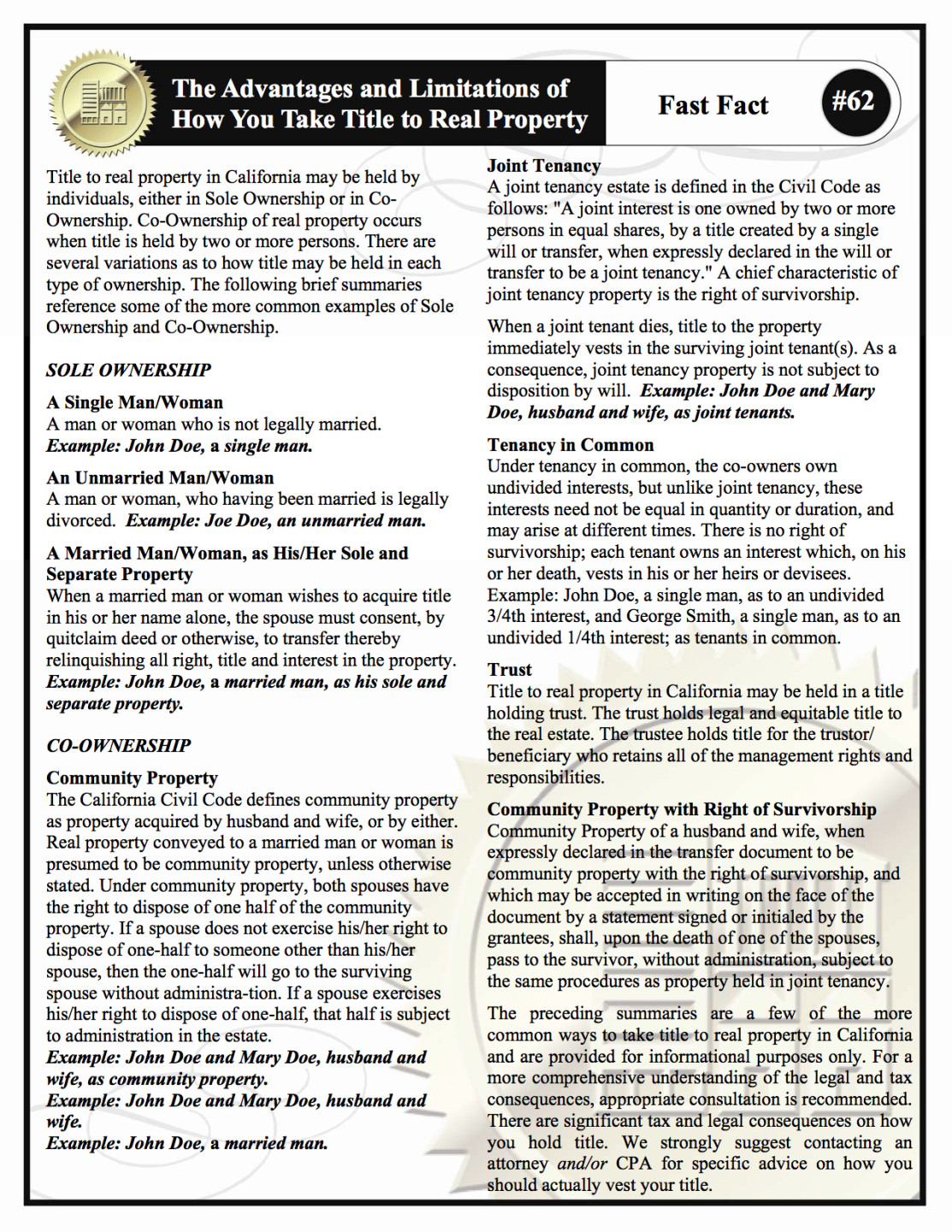

What are the most common methods of holding title to property in California?

There are plenty of big decisions that need to be made during the process of buying a home or condo. One decision that buyers often don’t consider in advance is how they’d like to hold title to the property. The method of holding title, often referred to as “vesting”, can have significant legal and tax implications so it should always be discussed with an attorney or tax pro. Before the sale can be completed, the title insurance company will need to know how the property is to be vested. Thinking about the options in advance may help to make the process smoother for you. The chart below from Fidelity National Title summarizes the more common methods of holding title. Click on the chart to enlarge it. If you are considering buying a home in SF (or anywhere else for that matter) just let me know, I’ll be happy to help.

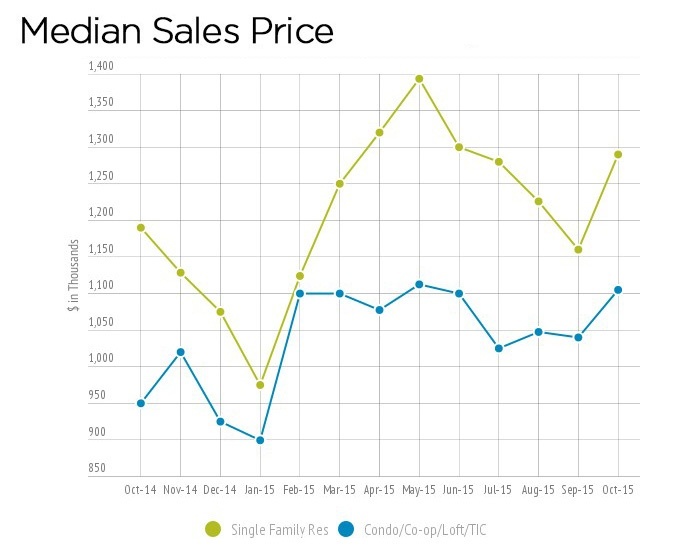

San Francisco Real Estate Market Update

Staying on top of market activity is critical in order to make an informed decision about buying or selling.

Check out my San Francisco market statistics for November

415.971.5651

415.971.5651

patrick@

patrick@

SF Office

SF Office