If you’ve been considering buying or selling a home, you’ve probably heard about MLS (Multiple Listing Service). Every region of the country has its own MLS which is the central database of all property listings in a particular area. The San Francisco MLS is SFARMLS. The MLS for Wine Country and Marin is BAREIS. The vast majority of property listings that you see on real estate websites all originate on the regional MLS.

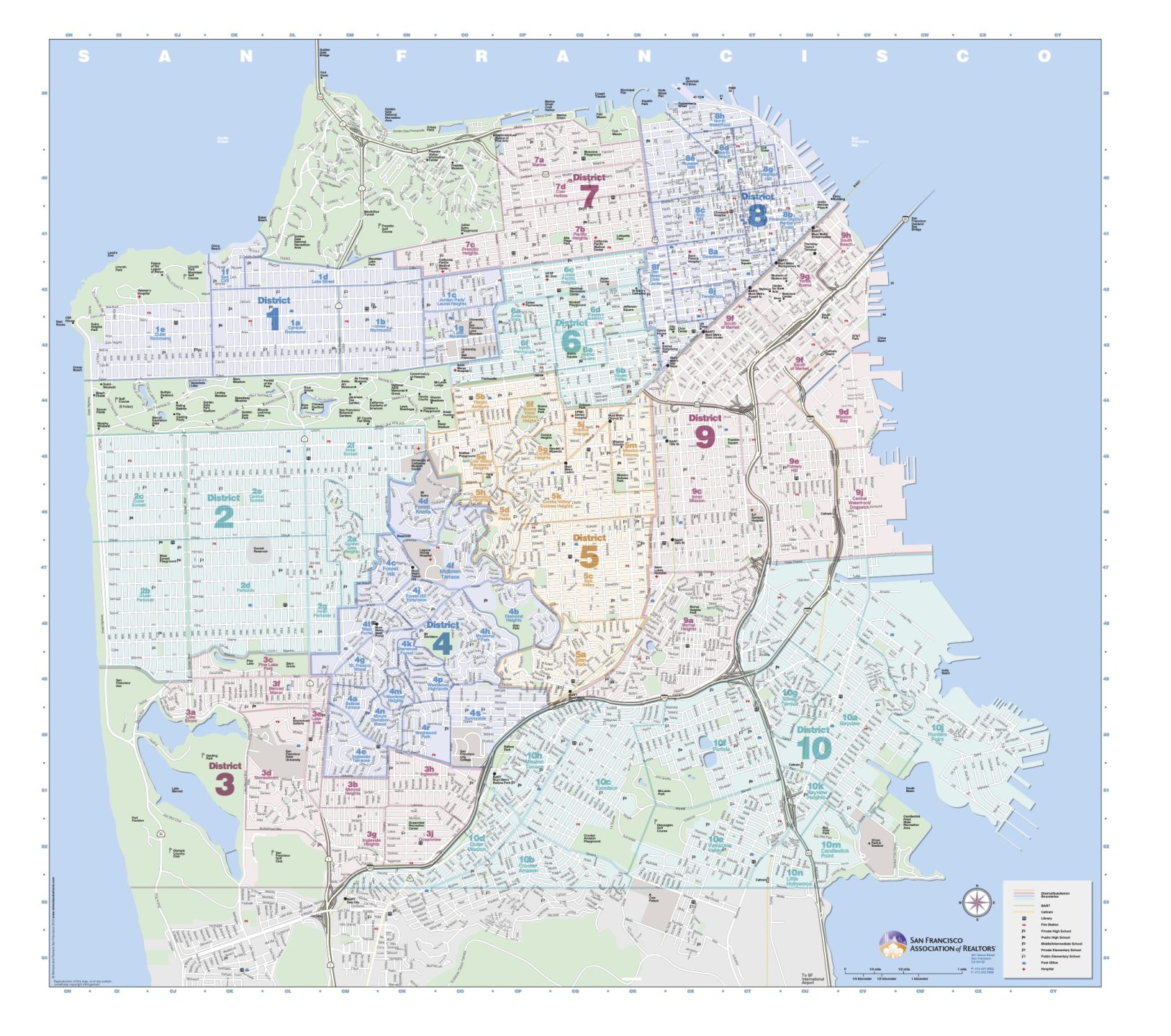

San Francisco is a small densely-packed city with houses, condos, multi-unit buildings, and TICs spread over a small 7 mile x 7 mile area. To organize all of those properties geographically, the San Francisco MLS has 10 districts and 89 sub-districts. Here’s a link to the official SFAR MLS district map.

I recommend searching MLS through Compass.com which allows you to see every listing available with every real estate company in the city. In addition, if you are not already working with an agent, my team and I will create a Collection for you which is a dynamic online board of properties that meet your specific criteria. It allows you to message me about a home in the app in real time, no need for lots of extra text messages or emails.

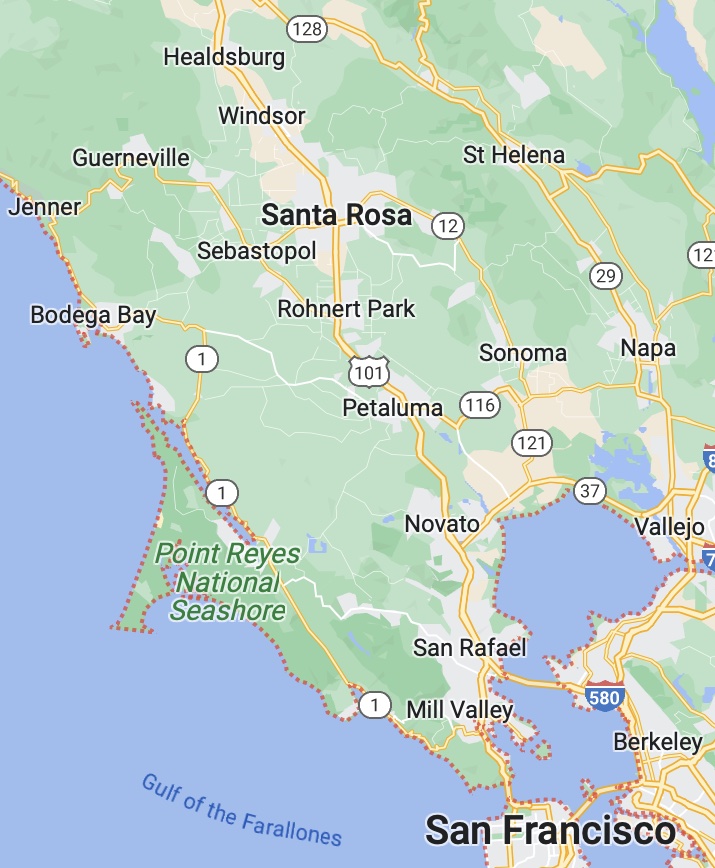

Did you know that I also represent clients in Wine Country? Here are some Sonoma County Wine Country listings currently available. This is just a sample, we have access to many more properties in the area.

Let me know if you are looking for a particular town in Sonoma County or specific price range and I’ll get to work on it.

We have “off-market” properties as well. Also known as Private Exclusives, they are at the request of the seller usually due to privacy reasons or other unique situations. Private Exclusives are only viewable to Compass agents and clients. Call me to check if we have anything that may fit what you’re looking for.

Whether it’s San Francisco, Marin, or Wine Country, my team and I are here and ready to help.

415.971.5651

415.971.5651

patrick@

patrick@

SF Office

SF Office